For Small Business Owners – Which Insurance Is Most Popular

Owning and managing a business comes with many responsibilities.

It is obvious that you cannot expect to run a profitable business without taking some risks- after all, “no risk, no reward“. But this doesn’t mean you have to take unnecessary and avoidable risks.

In fact, you should minimize your risks wherever possible.

One way you can do this is to take advantage of the protection that proper insurance gives you.

The US Small Business Administration website is very helpful in highlighting the importance of insurance for small business, and the steps you should take:

- Assess your risks

- Find a reputable licensed agent

- Shop around

- Review the risks every year

It may not be the perfect solution for you to go to your local insurance agent or to visit the insurance company’s office and ask for their advice on what insurance you should take out for your business.

The value of the answer you get will depend very much on the questions you ask, so sometimes you may end up with the wrong kind of insurance, or not enough to protect you in case of unforeseen catastrophe.

One of the most popular solutions is to “Ask Google“, and here again, the quality of the answer you get depends on your question.

If you are confused, then help is at hand – getting it from Google just means asking the right question, and having a way to make the answers more meaningful.

We will do that here, as shown in the following sections.

What are the questions small business owners ask about protection?

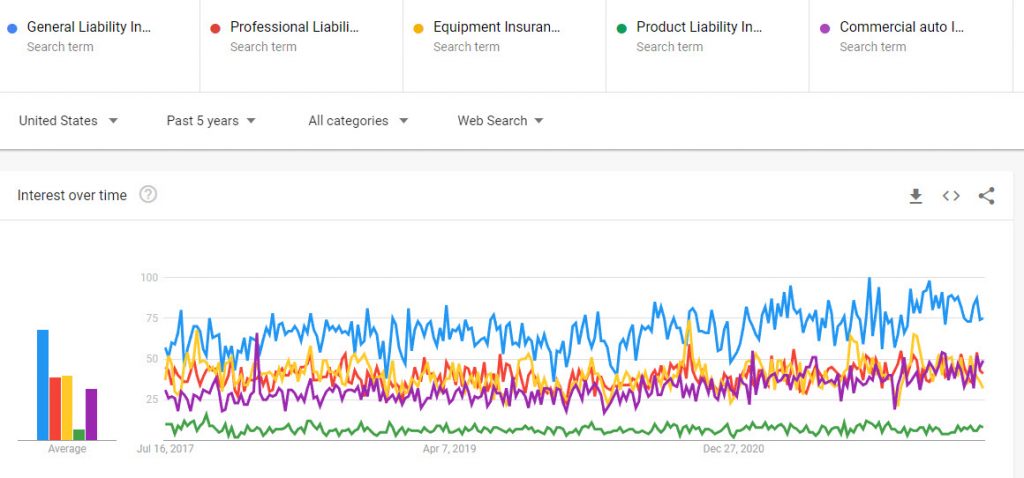

Google tracks the main questions its millions of users ask.

With this data, it composes a simple graph that can help you pinpoint the kinds of insurance other small business owners are interested in.

Click on the picture below to get the latest updated information, and don’t forget to select the “Top” responses.

The individual insurance types have been chosen based on the experience of the many small business types that we have been analyzing and writing on this website.

General liability insurance

General liability insurance is the most common insurance all businesses need, regardless of the type of business and the size of the operation.

General liability insurance protects the business owners in case a third party (that is, someone other than the business owners, their family or an employee) suffers some form of injury or damage while visiting the place of work.

It is commonly known as “trips and falls” cover, describing the most usual cause of a claim, when someone trips over a object left lysing in the pathway, or falls into a hole left without proper barriers or warning signs.

The person can sue for recovery of all damages and associated costs, including medical treatments, loss of income, pain and suffering and all the other possible damages to health and assets.

Professional liability insurance

Professional liability insurance protects any business that provides specialist or expert services to its customers.

It’s also known as Errors & Omissions insurance for tradesmen, and Professional Indemnity insurance for lawyers, accountants and medical service providers.

It protects in case a customer or client claims that the services provided were not correct, were not as required, or were inadequate.

Equipment insurance

Equipment insurance protects a business’s assets like tools, equipment, work benches and all the other specialist equipment that are used in the conduct of business.

In case of theft, accidental damage by storm or fire, the insurance will cover the cost of replacement.

Product liability insurance

Product liability insurance protects your business if you sell or supply products to your customers.

The performance of the products must meet the intended and promised standards, otherwise you could be sued for consequential losses, even if you are just the last link in the supply chain.

Commercial auto insurance

Commercial auto insurance is essential for any vehicle, and is not provided by private vehicle insurance.

Using a private auto for any sort of business activity voids the insurance, and leaves you subject to total exposure to the consequences of any accident involving the vehicle, as well as being in breach of state and federal laws.

With the data gathered from Google, we can present an animation that cycles through the dates in the graphic, showing how the relative search levels changed over the period.

This should give you a good idea of what every small business owner has been looking for over time.

The moving bars in the graphs show you the relative importance of the search phrases business people have been asking on Google.

You can let the graph run, pause it or run back to any point in time to see the data more relevant to whatever you are looking for.

Using different search phrases in Google

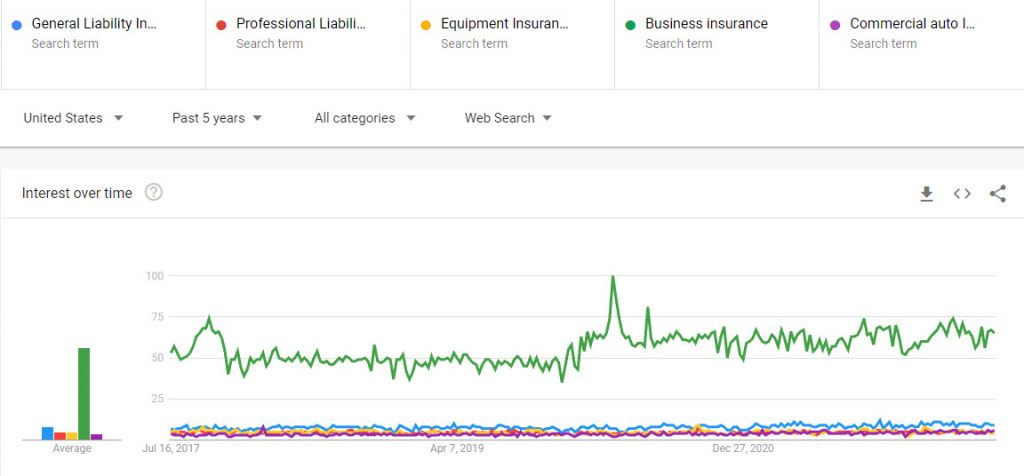

Every small business needs to focus on the kinds of insurance it requires.

In this graphic, it shows a comparison of some other types of protection.

Like the one above, click on the picture to get the latest information, then select “Top” to see the most frequent queries other businesses are asking.

In this graph, we have chosen some different insurance types.

The individual insurance types have been chosen based on the experience of the many small business types that we have been analyzing and writing on this website.

Business insurance is more often known as a Business Owners Policy (BOP) and it combines the protection of General liability with commercial asset insurance.

Usually, it is cheaper than individual policies, and other special covers can be added, like Director’s liability, Cyber cover.

Are you looking for a business that closely matches your own?

Here at 4menearme.com, we have been researching and writing for many years to highlight the insurance requirements of different kinds of small businesses in the US.

A quick visit to our Site Map page will list for you all of the articles we have written for different business types.

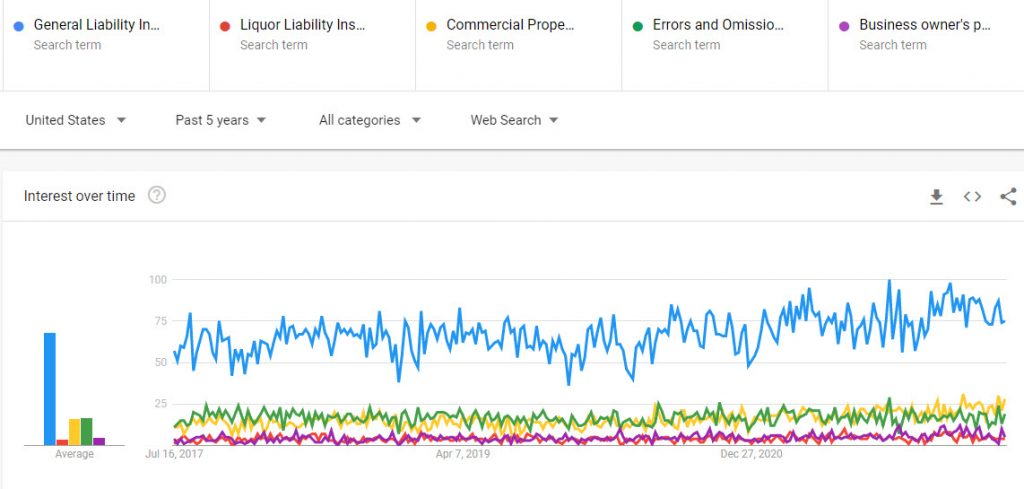

The graphic below represents the most common business insurance requirements across all of these business types.

Click on the picture, then select the TOP trending queries.

Liquor liability insurance protects any business that is involved in any way with provision and serving of alcohol to customers.

It’s necessary for a wide range of businesses, such as DJs, Nightclub owners, Event Planners, Music Venues and others.

It protects in case a customer or client claims that they were provided with drinks improperly, or in breach of regulations.

Commercial property insurance is essential for any business that owns or leases premises for any sort of business activity

This includes businesses that use some part of the business owner’s home, because business activity voids the private insurance, and leaves you subject to total exposure to the consequences of any event on the premises.

It covers your business in case of major catastrophic events like fires, earthquakes, storm damage, as well as in case of deliberate vandalism.

Usually, it is cheaper than individual policies, and other special covers can be added, like Director’s liability, Cyber cover.

FAQ

What are the most popular small business questions on Google?

Just as an example, try typing “small business insurance” into your Google search bar and see if you get the same answers we got:

- What are the three basic types of insurance for business?

- Who has the cheapest business insurance?

- What are the three most common insurance needs that all businesses must have?

- Do you need insurance to run a business?

- What are the four basic insurance coverages that most businesses have?

- What is the one type of insurance that every business needs to have?

There are no themes of final answers on Google searches – just a lead on things you should follow up on.

What insurance types are obligatory for small businesses?

There are two kinds of insurance that all businesses may be obliged to take out, and for which fines and even jail time may be imposed if they are not held by a company or individual engaged in commercial activity.

These are:

Workers Compensation Insurance

In most states, it is mandatory for every business to have Workers Compensation Insurance if it has more than the state-set number of employees.

Workers compensation insurance covers any costs that arise if an employee experiences an injury or becomes sick due to their work. “Employee” does not just mean full-time workers.

It includes part-timers, temporary, casual workers, and subcontractors.

The laws and regulations in each state are different.

The National Federation of Independent Businesses (NFIB) summarizes each state’s worker compensation requirements.

Commercial Auto Insurance

It is mandatory to have third-party accident insurance on all vehicles.

Each state sets its own requirements.

You can view the necessary details for your state.