Free Break Even Point Calculator for Business

Every business must know its break-even point to survive. We invested our time and expertise to curate an algorithm that helps you calculate your break-even point easily. Let’s see how this free business break-even point calculator simulates your business in minutes and eliminates the guesswork.

The algorithm allows you to manipulate the following four co-occurring input variables speculatively:

- Fixed costs

- Number of units to sell (volume)

- Variable cost per unit

- Unit selling price

There’s a responsive cursor to manipulate each variable, sliding the bar-holed to the right or left to enter your data.

This game-changing break-even point calculator simulates the correlation between these inputs, helping you to see how each variable impacts your break-even point.

It predicts the total revenue and pretax profit.

The relationship between the total revenue and pretax profit is the most reliable way to achieve the break-even point.

This business break-even calculator is easy to use and helps you determine the critical elements to reach your business goals without any guesswork. Use it to make better financial decisions for a more profitable future.

Understanding How Businesses Get To the Break-Even Point

Every business has its expenses, both fixed and variable. Always, the goal is to be on the profitable side of the equation. The balance sheet equation states that a business should bring in more money than it spends.

Thus, getting to the break-even point means a business is neither making profits nor losses.

Sometimes, hitting and maintaining the break-even point is praiseworthy, especially if the business employs many people or provides needed services in the community.

Thus, corporates and small businesses need break-even point calculators, but so do non-profits. Understanding where they need to be to remain operational is an integral part of budgeting and forecasting.

Fiscal Practices Needed to Reach the Break-Even Point

A balance sheet is the most accurate way to track a business’s financial health. It lists both assets and liabilities, which helps to calculate net worth.

The break-even point is when all the expenses match up with revenues, resulting in zero profit or loss.

The fiscal discipline required to reach the break-even point is substantial, and any business owner or manager should focus on three primary areas.

1. Accurate Forecasting

Trust is only subject to the future, and accurate forecasting is vital for predicting the costs and revenues associated with a business. The dynamics of any market can fluctuate quickly, just like the break-even point shifts with revenue and expenses.

Businesses need to adjust their forecasting process when any significant element changes. For example, if an expense drops significantly, the break-even point will move downward, but if revenue drops, then the break-even point will move upward.

Data analytics can help business owners and managers to understand the impact of changing market conditions. It helps to adjust break-even point calculations for a more accurate assessment of the financial health of the business.

2 Cost Management

Quantities of scale are excellent, but they’re often inaccessible because of capital or demand constraints. Managing operational costs entails balancing the multi-dimensional costs associated with the production process, from raw materials to labor.

Small businesses need to assess their fixed and variable costs to determine what spending is necessary to stay profitable.

Fixed expenses are challenging to change, but business owners can minimize costs in production, distribution, and marketing. Getting the most ROI on each dollar also helps to reduce variable costs.

Efficiency is crucial, and small savings can significantly reduce the break-even point.

Quantifying costs and measuring them against returns is a great way to stay on top of costs.

Small business insurance is an underrated saving for small business owners. Investing in the right insurance can help protect against incidents that could cripple a business’s finances.

For example, investing in property and casualty insurance can help mitigate liability and costs associated with losses due to theft, damages, or injuries.

3. Revenue Generation

Every business aspires to grow, and the key to growth is customer acquisition. More sales lead to higher revenues, which means a lower break-even point.

But how do you make more revenue? You can increase revenue by surging prices and end up with fewer customers.

It’s also counterproductive to decrease unit prices drastically to create artificial demand, as the business might bleed out capital.

Product research, marketing, and customer service are crucial components of revenue growth. Businesses need to understand the target audience to offer products, services, and experiences that are meaningful to them.

Or, you can aim to increase sales with marketing and promotional activities that reach more potential customers.

The right mix of advertising, promotions, partner networks, and content marketing is essential for acquiring new customers.

Businesses also need to focus on customer retention because keeping existing customers costs significantly less than finding new ones.

How To Calculate Break-Even Point for Your Business

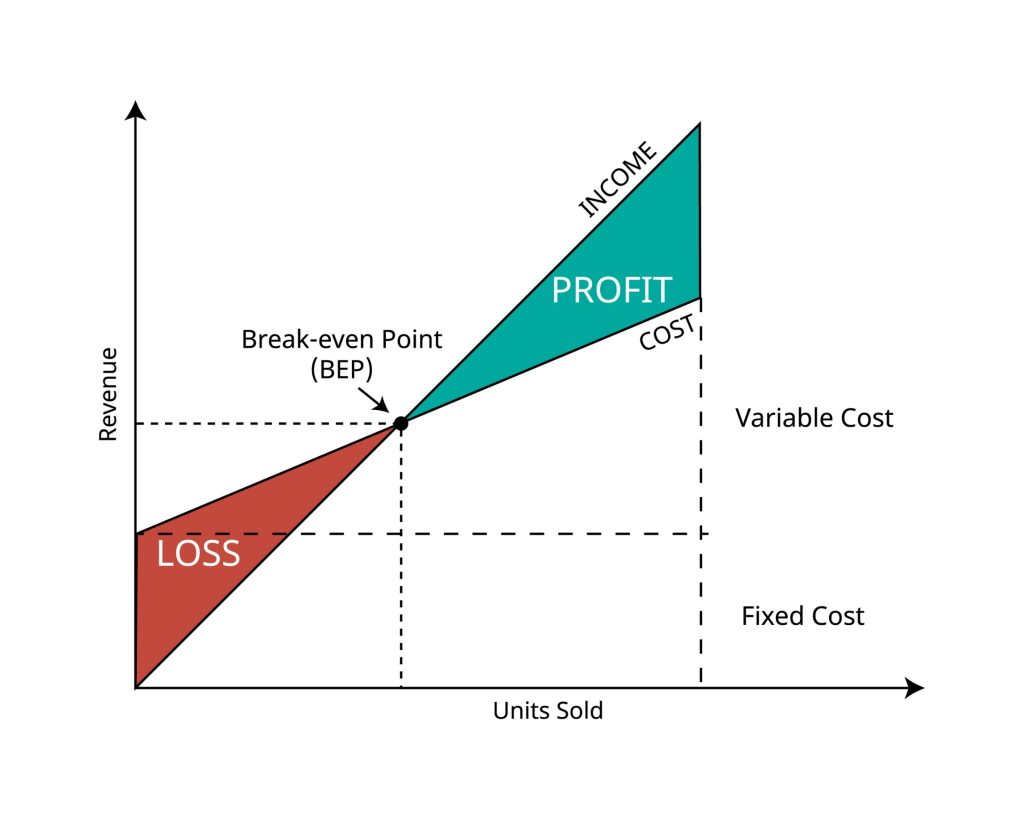

The break-even point (BEP) is the intersection between total costs and total revenue. It’s a key indicator of profitability, as it indicates when a business can expect to start turning a profit.

To calculate the break-even point, you need to divide your fixed costs by the difference between your unit price and variable cost.

There are four dynamic and co-occurring variables at play, so using an accurate break-even calculator can help you find the BEP quickly.

In layman’s terms, it’s the number of units you must sell to cover all your costs.

For example, let’s say you have a business selling t-shirts for $20 each with variable costs (materials and labor) of $10 per unit. Your fixed monthly costs are $5,000. How do you decide how many t-shirts you must sell to break even?

The Co-Occurring Input Variables To Compute Break-Even Point

To calculate your break-even point, you need to input the following data:

- Fixed costs

- Number of units to sell (volume)

- Variable cost per unit

- Unit selling price

Quantities of scale affect the variable cost per unit by increasing the profit margin and reducing overall costs.

For example, let’s say you have a business that produces handmade wooden furniture. Your fixed monthly costs (rent, utilities, employee salaries) stand at $5,000.

The estimated raw material cost for each unit is $250, and the selling price is $500. How many chairs do you need to sell to break even?

More About Variable Cost per Unit

The total revenue or income of a business is determined by multiplying the total units sold by their respective prices. You can calculate the gross profit margin by subtracting the variable costs from the total revenue.

The variable cost per unit depends on several factors, including the production process and quantity of materials used to make a single product. The more efficient your production process, the lower will be your variable costs per unit.

Businesses can also benefit from economies of scale when the demand is high, and it’s possible to finance large orders to reduce costs.

Revenue vs. The Sales Volume

The number of units to sell depends on the product demand and the ability to market it. You can increase sales volumes via promotional offers and targeted marketing.

Your break-even point helps you understand how much money is necessary to cover all the costs. It’s also essential in determining pricing strategies and evaluating potential profits.

By factoring your fixed costs, variable cost per unit, and the unit selling price, you can calculate the revenue and estimate how many units you must sell to break even.

Break-Even Point (BEP) Formula

The Break-Even Point (BEP) formula is a fundamental financial analysis tool used to determine the point at which your business neither makes a profit nor incurs a loss. The formula for calculating the break-even point in terms of units sold is:

Break-Even Point (Units) = (Fixed Costs) / (Price per Unit − Variable Cost per Unit)

Here’s a breakdown of the formula:

- Fixed Costs: These are the costs that remain constant regardless of how much you sell. Examples include rent, salaries, and insurance.

- Price per Unit: This is the selling price for each unit of the product or service.

- Variable Cost per Unit: These are costs that vary with the production volume, like materials and labor directly involved in production.

The break-even point is reached when the total revenue equals the total costs (both fixed and variable). At this point, the business is not making a profit, but it’s not losing money either. Understanding the break-even point is crucial for making informed pricing, marketing, and investment decisions, as it helps to know how many units need to be sold to cover costs.

The Lowdown

Knowing your break-even point helps you manage expenses, determine pricing strategies, and identify the potential profits of a business. It’s essential for evaluating the worth of risk in a venture.

This free, online break-even calculator makes it easy to calculate your BEP by inserting the fixed costs, the number of units to sell (volume), the variable cost per unit, and the unit selling price.

You can then use this information to adjust other business pricing strategies.

Don’t forget, small business insurance covers the costs of unexpected events that could affect your venture.

At 4MeNearMe.com, we can help you find the right cover and provide a tailored quote. Ready to get started? Let us help!